“The supreme art of war is to subdue the enemy without fighting.”

― Sun Tzu, The Art of War

When your business is forced to accept a price that is fixed by the government, keeping a good eye on macroeconomic conditions is part of your job description. This is a particularly important part of your job when government rates are going to be in place for five years at a minimum and affect the entire world. I say “at a minimum” because as we have seen with the Phonorecords III remand, you can be stuck with crappy rates for much longer if you have soulless counterparts. And we do.

There was one bright light in Phonorecords IV. Songwriters will recall how the Copyright Royalty Board rejected the negotiated private settlement by the NMPA, NSAI and the RIAA on physical records and downloads. Due to the outcry from independent music publishers and songwriters not represented by that bargaining group, the CRB then forced a new negotiation. That negotiation resulted in a settlement that raised the statutory mechanical rate for physical records–plus a cost of living adjustment based on a Consumer Price Index.

This inflation adjustment makes the statutory rate for songs on physical goods and downloads similar to the “administrative assessment” for the MLC, Inc. that the Copyright Office put in charge of operating the mechanical licensing collective. (The MLC also has an inflation adjustment in the “assessment” which is the sum paid by services to cover its operating costs.)

Unfortunately, the NMPA and NSAI were unable to–or in any event didn’t–negotiate a cost of living adjustment on streaming mechanicals. There was also an outcry from independent publishers and songwriters not represented by the NMPA and NSAI, but it was too late. Instead they agreed to extend the trickle down royalty structure largely based on revenues rather than share price. Another missed opportunity. Oh well, maybe next time.

Why is the topic of inflation important right now? When negotiating a five year statutory rate, one might want to study the five year trends in global macroeconomic conditions. For example, consider the Conference Board’s leading economic indicators, everyone else does. That metric has been a good predictor of the economic future. As you’ll see from the chart, we are currently in the 14th straight monthly decline–the longest streak of declines since the Lehman Bros. collapse in 2008. That record was 22 straight months of declines from June 2007 to April 2008.

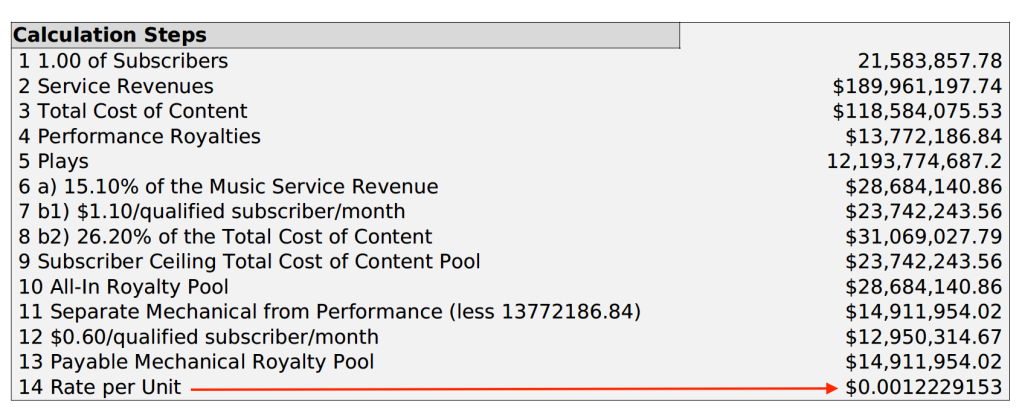

Given these shockwaves, one might anticipate a recession ahead that highlights the need to preserve purchasing power. One might also want to develop a mindset or theory about how inflation would rot away a fixed rate of return ordered by the government, such as the statutory mechanical rate. Even if one accepted the lack of.a crystal ball, economists make projections all the time, particularly five year, i.e., short term, projections. (Remember that physical mechanicals is a fixed penny rate so inflation rot is easy to measure. Streaming mechanicals is a bizarre formula that changes the result from month to month and so it is easier to hide the mechanical rot from the actual pennies–which almost always start three to four decimal places to the right, anyway.)

How “Sticky” Is Inflation?

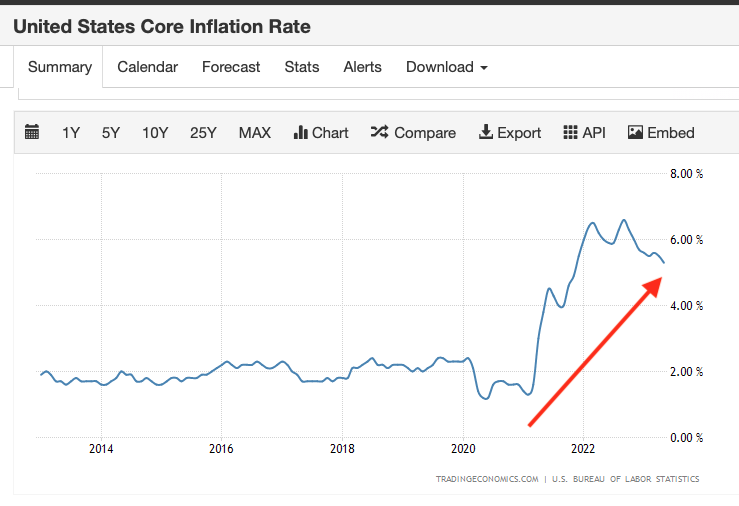

Without reading too much into the global macroeconomic situation, it is pretty simple to see that “core” inflation (like housing, but excluding food and energy) is pretty “sticky” meaning it is not decreasing much despite the best efforts of the central banks, including our own Federal Reserve. US core inflation actually increased in the most recent period. How is it in the rest of the world? Consider the BRICS.

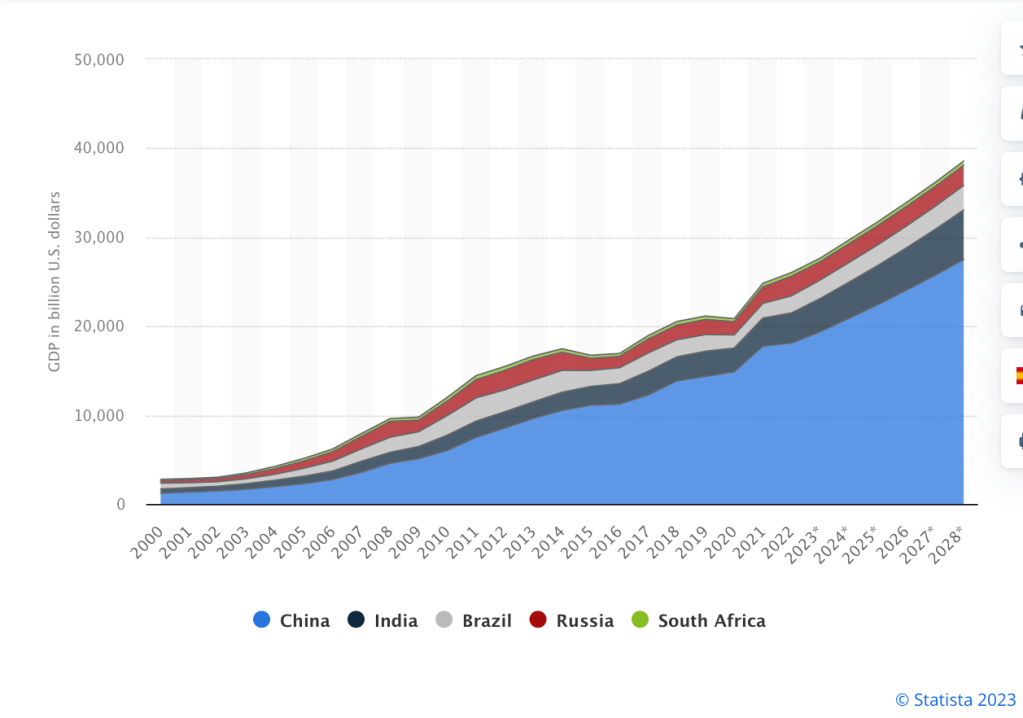

You may have heard of the annual “BRICS” Summit to be held this year on 22 August in Durban, South Africa. BRICS is an acronym of the Brazil, Russia, India, China and South Africa “Partnership for Global Stability”. That’s right, they think they are about the business of “global stability.” Realize that the BRICS bloc combined had a GDP over US$26.03 trillion in 2022, which is slightly more than the United States. When someone tells you who they are, believe them.

One of the ways these countries partner for global stability is with currency. A stable currency helps to fight off the inflationary trends associated with the world’s current prime reserve currency, the U.S. dollar. Together these countries account for a substantial amount of world trade and gold reserves. Is it any wonder that BRICS has formed the New Development Bank and the BRICS Contingent Reserve Arrangement as alternatives to Bretton Woods?

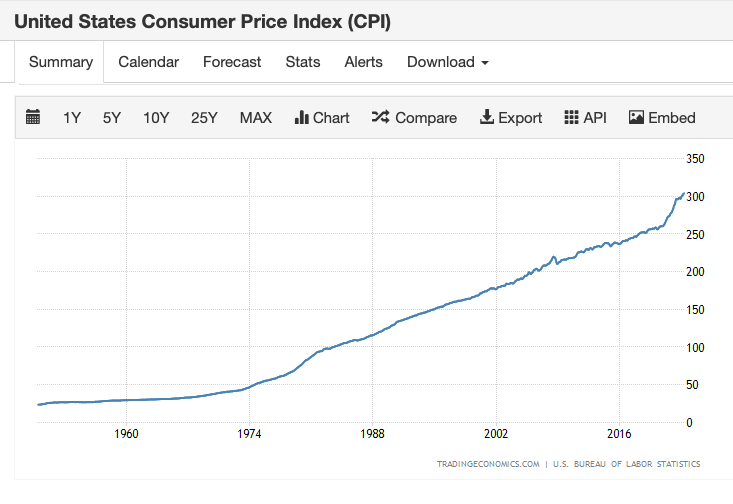

Why would a currency backed by gold be attractive? It stops governments from printing vast quantities of currency for one thing. Pegging a currency like the dollar to the price of gold acts as a brake on government spending which is inflationary. Consider that inflation in the US has steadily risen at nearly a 45 degree slope since around 1972. Now what might have happened in 1972 that could help explain that rise?

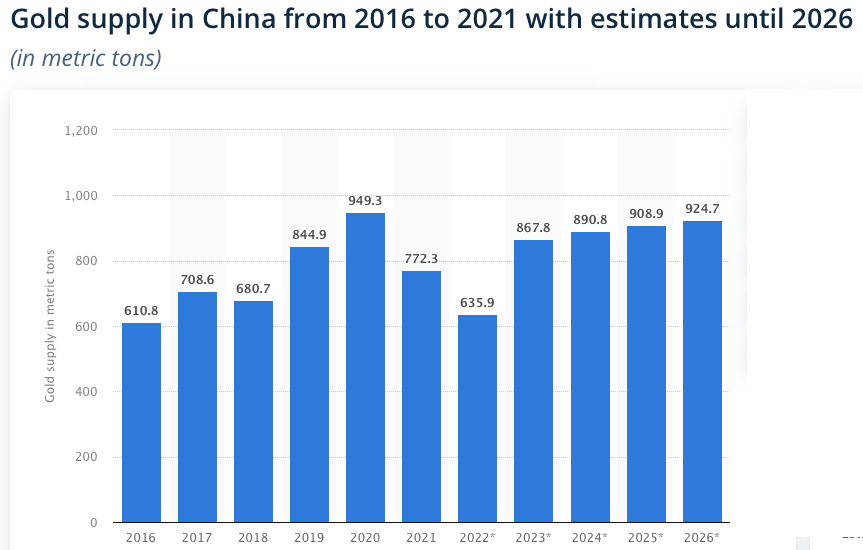

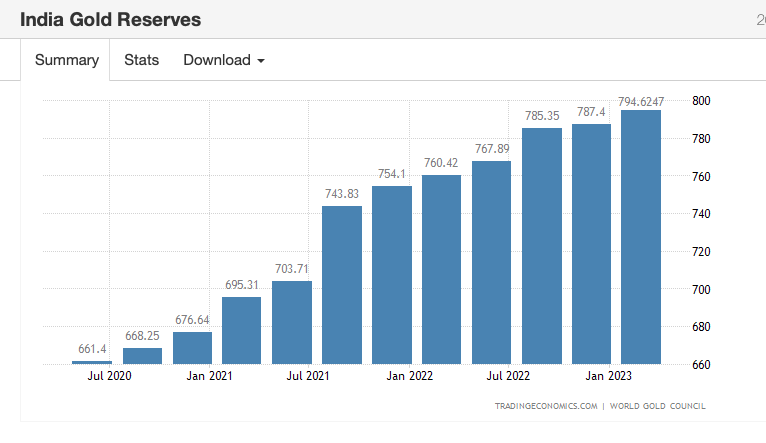

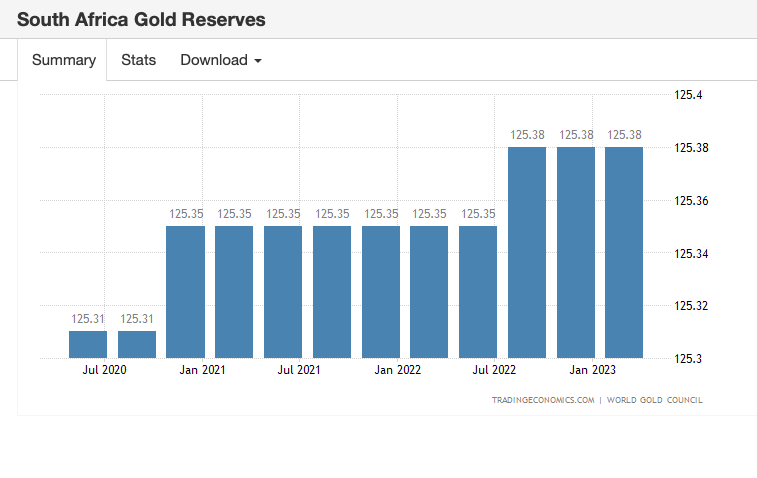

It should not be surprising then that BRICS members have been increasing their gold reserves over the last few years, which is what one would expect to see in advance of forming a currency union pegged to gold. While none of these countries have currency strong enough to challenge the dollar, what if they together were to peg a new currency to gold, what Joseph Sullivan writing in Foreign Policy called a “bric”? What then? No single currency of the BRICs is well suited to replace the dollar, but if a basket of these currencies were pegged to gold, that might be different. If a bric were pegged to gold, we might have a ball game that could displace the dollar as a reserve currency at least in the BRICS countries.

If that was the plan, would you expect to see the BRICS accumulate gold by purchases in the open market to increase their respective gold reserves?

It should also be noted that the weaponization of the US dollar against Russia seems to have had no effect on BRICS. Their global summit will be held in Durban, South Africa recent events in Russia notwithstanding. In fact, it probably is not an overreach to say that not only do these countries not seem to care about being blocked from the SWIFT banking system, the US may find itself blocked from a BRICS banking system and at least given a strong push toward being dislodged as the world’s prime reserve currency.

We’re going to talk about what that means and how it could happen. In a nutshell, the effect on songwriters without inflation protection could be as bad as when the government froze rates from 1909-1978, except in a much more compressed time frame.

There are signs and portents. You’ve probably seen press reports about China making significant commercial deals that promote its renminbi (yuan) currency in large scale sovereign resource and development contracts in bilateral agreements with resource-rich BRICS countries. This is particularly seen with China leveraging its position as the largest crude oil importer and recently surged commerce with France, America’s oldest ally. While there’s a long way to go before the renminbi unseats King Dollar as the world’s prime reserve currency, the point is that China is really trying hard to make that happen which is a first. The downside of losing prime reserve currency status would be as devastating as a war and would result in hyperinflation the likes of which America has never seen.

Of course, we won’t go straight to being Argentina, but there could easily be pressures along the way that would cause our inflation to spike, particularly for those who live off of wages fixed by the government from Social Security to the statutory mechanical royalty rate. This makes fighting for Cost of Living Adjustments all the more important. Just ask the MLC how they protect their administrative assessment.

Sleeping Through the Wars

Let’s go back to February 23, 1998. Like most days, there were some odd coincidences. The U.S. Air Force announced that the iconic RQ-4 Global Hawk drone was cleared to file its own flight plans and fly in civilian air space in the United States. Pam and Tommy got divorced. President William Jefferson Clinton was bogged down in a personal crisis of his own making. Celine Dion was number one with a song from a movie about an unsinkable ship that sunk.

The U.S. was a debtor country, meaning our balance of payments was negative. Howard Stern’s radio show premiered on WAVF in Charleston, South Carolina.

And a fellow most of the world had never heard of declared war on the United States. None of the smart people noticed. We were, after all, Fortress America, etc., etc., and did not pay attention to such things.

Well, it wasn’t quite a declaration of war as we know it. Al-Quds al-Arabi, an Arabic newspaper published in London, printed the full text of a document in Arabic titled “Declaration of the World Islamic Front for Jihad against the Jews and the Crusaders” (now studied at West Point). That document was ostensibly signed by a relatively unknown Saudi financier who masterminded the August bombings of the US embassies in East Africa, and even more obscure leaders of militant Islamist groups in Egypt, Pakistan, and Bangladesh. That Saudi financier was named Usama bin Ladin, and the smart people paid him no mind, not even when he repeated the fatwa on CNN the next year. When someone tells you who they are, believe them.

China Declares a People’s War on the US

Another event happened in 1999, less than a year after UBL’s fatwa. Two colonels in China’s Peoples’ Liberation Army of the Peoples Republic of China published a book in Mandarin entitled Unrestricted Warfare. The title is variously translated as Unrestricted Warfare: Two Air Force Senior Colonels on Scenarios for War and the Operational Art in an Era of Globalization, or the more bellicose Unrestricted Warfare: China’s Master Plan to Destroy America.

You’ve probably never heard of this seminal book. The colonels’ thesis is that it is a mistake for a contemporary great power like China to think of war solely in military terms; war includes an economic, cyber, space, information war (especially social media like TikTok), and other dimensions–including kinetic–depending on the national interest at the time. The colonels offered an extension of Western thinkers with Chinese characteristics.

I think of Unrestricted Warfare as an origin story for China’s civil and military fusion policy, later expressed in various statutes of the Chinese Communist Party that were on full display in the recent TikTok hearing before Congress. Although the book was translated and certain of the cognoscenti read it in Mandarin (see Michal Pillsbury and Gen. Rob Spencer), it was largely unnoticed right next to Bin Ladin.

Except in China–the CCP rewarded the authors handsomely: Qiao Liang retired as a major general in the PLA and Wang Xiangsui is a professor at Beihang University in Beijing following his retirement as a senior Colonel in the PLA (OF-5).

The point of both the 1998 fatwa and Unrestricted Warfare is that no one in the West paid attention. We know where that got us with bin Ladin, there are movies about it.

Fast forward 20 years to May 14, 2019 when the CCP government declared a “people’s war” against the United States as reported in the Pravda of China, the Global Times operated by Xinhua News Agency (the cabinet-level “news” agency run by the CCP):

The most important thing is that in the China-US trade war, the US side fights for greed and arrogance … and morale will break at any point. The Chinese side is fighting back to protect its legitimate interests. The trade war in the US is the creation of one person and one administration, but it affects that country’s entire population. In China, the entire country and all its people are being threatened. For us, this is a real ‘people’s war.’

And “people’s war” has a specific meaning in China:

People’s war, also called protracted people’s war, is a Maoist military strategy. First developed by the Chinese communist revolutionary leader Mao Zedong (1893–1976), the basic concept behind people’s war is to maintain the support of the population and draw the enemy deep into the countryside (stretching their supply lines) where the population will bleed them dry through a mix of mobile warfare and guerrilla warfare.

So in the dimension of unrestricted warfare, what end state would the CCP like to achieve? Bearing in mind that they will avoid a shooting war in favor of the various other dimensions of civil-military fusion and following Sun Tzu’s admonishment to subdue the enemy without fighting. One way would be to impose economic damage on the United States (and really the West) but to do so in a way that does not damage China’s economy or not as much. A prime example might be establishing a military base for electronic and biological warfare in Cuba right before they take Taiwan off the board. Go, not checkers.

Dedollarization

Another way to do that would be by fully or partially displacing the U.S. dollar as the world’s prime reserve currency. And it helps if you think of the U.S. or France the way China does, as a market for Chinese goods. Forget the iconography of the White House or the Élysée Palace; try thinking of the presidents of the U.S. and France as the regional VPs of sales for China, Inc. with Xi Jinping as the Chairman of the Board. That may well be how Xi thinks. It’s certainly how he acts.

What is all this talk from the CCP of breaking morale, people’s war, economic warfare? You mean aside from a few key chapters in Unrestricted Warfare, the manual for the CCP’s hegemony?

First, let’s take an example of the world as it existed on February 8, 2022. And let’s say you are the President of Steppestan, a Central Asian country and CCP buffer state with two natural resources in abundance located a stone’s throw from China’s border: large oil fields and cobalt deposits.

Prior to February 8, 2022 if you wanted to sell your oil, you would almost certainly need to fulfill those trades in U.S. dollars, also called the petrodollar. (President Nixon took us off the gold standard and effectively pegged the dollar to the price of oil when Nurse Ratched wasn’t looking in return for protecting the security of Saudi (see United States-Saudi Arabian Joint Commission on Economic Cooperation.))

So that means that you as President of Steppestan need to find another country, let’s say China, that has dollars to close these oil trades. You’re in luck–China has a bottomless pit of dollars. Well…not bottomless as we will see, but it looks bottomless in February 2022. So Steppestan and China enter into a private “output” deal, a long term contract for Steppestan to provide China with oil for about 30 or 40 years. This contract will require the trades to be closed in dollars unless both sides agree on a different currency. Because Steppestan and China are not going to be pushed around by the American neo-imperialists forever, right? See “people’s war” above.

And since this is an output deal and Steppestan is essentially providing all the oil China can buy from them, the price of oil will be discounted so that China is protected from price fluctuations imposed by OPEC+ (OPEC plus Russia…ahem…and some of the other stans). That means that if OPEC+ decided something, oh say, for example, to cut production and increase the price of gasoline at the pump before a U.S. Presidential election, it won’t affect China at all to the extent of its output deals like they have with Iran.

For the moment then, Steppestan and China agree to denominate their deal in U.S. dollars, which provides you the dollars to do all kinds of other business that also are denominated in dollars. And of course, it’s not just these deals; the Bank for International Settlements shows 90% of this type of transactions were dollar denominated. This is what it means to be the prime reserve currency. It means that your dollars are good everywhere and everyone wants to hold dollars. It means there is a great temptation to continue printing these valuable dollars as if they were inflatable magic gold. It also means that there may be an audience of people who are tired of holding inflated dollars given the trainwreck at the Federal Reserve, fiscal dominance by Congressional appropriators, bank failures, and other alarming events.

Why is the Dollar the King?

There are a few reasons why the dollar has been and currently is the currency of choice for all countries in the world. The U.S. financial industry is pretty well regulated (aside from the 2008 financial crisis, several recent bank failures, massive deficits and high inflation), we have rule of law so don’t have riots in the streets (ahem…), and our currency is stable (aside from devaluing the dollar due to high inflation, high interest rates, and giving up on our manufacturing base despite Mike Rowe’s best efforts).

Now as President of Steppestan, you need to spend those U.S. dollars you got from China in return for oil. You can buy stuff made in America or American assets like real estate or stocks of U.S. companies. You can spend the dollars as fast as you make them, but if you just want to put a little aside, now what? You’ve got a pile of dollars in your central bank that needs to get invested, so where do you put these “reserves” (as in “prime reserve currency” as opposed to “transaction currency”).

Where will you invest your country’s dollar reserves? Well, you want a well-regulated financial system, rule of law, low inflation, all the same things your grandparents wanted with your college fund. But unlike grands, you will want that investment to be liquid, so you can move your money around from instrument to instrument, or raise cash as needed. Plus there’s never been a question that the U.S. would pay its bills and would not refuse to pay if you held those treasury bonds to maturity or pay interest on the debt obligations for any reason. Like if the U.S. government decided Steppestan was a bunch of bad people–it doesn’t only have to do with being able to pay, it could be purposely refusing to pay today in a form of sanction like a blocked account.

For decades, really in the post-WWII era, many countries have chosen U.S. treasury debt, not solely because Hitler was dumb enough to get into a bombing campaign with a country his bombers couldn’t reach, but really because the U.S. ticked all the boxes as a good investment. One could also say that a significant reason was because nobody tried to challenge King Dollar as the world’s prime reserve currency (or in the post WWII era really was able to–see Bretton Woods). That was because nobody wanted to make unrestricted warfare against the U.S. in the economic dimension or declare a people’s war in that dimension. At least not until now.

When Sanctions Backfire

And until February 8, 2022, the U.S. hadn’t really gone after another country the way it went after Russia–which may have a direct effect on the ability of the US to finance deficits. Now remember–due to fiscal dominance by the appropriators, there has never been an effective limit on what Congress could spend because if Congress could pass it, the Federal Reserve would find the money somehow, even if they had to buy toxic assets and print money to buy bonds they couldn’t sell to people like Steppestan or China.

So you could say that the leverage that these other countries have is not just that they hold U.S. debt, it’s that they are willing to continue to buy U.S. debt, even during the Federal Reserve’s Zero Interest Rate Policy (or “ZIRP” which sounds like something General Zog might say). In other words, there were people willing to buy U.S. treasury obligations that paid no interest, and that helped Congress drive up the price of all assets.

You’ll often hear that U.S. treasury debt is backed by the “full faith and credit of the United States”. That’s true. But what does it mean? It sounds like a latter day Nicene Creed or something but there’s actually a very simple secular explanation for this “full faith and credit” thing. Look in the mirror and there it is. The full faith and credit of the United States is you and me and generations yet unborn,

What this does is allow the U.S. to borrow unbelievable amounts of money. When you hear “Congress spent” take a closer look and you’ll see that a good chunk of the dollar figure that follows “spent” was borrowed. Imagine if journalists got fact checked into saying “Congress borrowed”? Do you think that would be a different reaction?

The End State of Economic Warfare

At the moment, emphasis on “moment”, that is all working out, but you can see what would happen if a country wanted to engage in economic warfare against the U.S., or more broadly, the West. All they’d have to do is offer better terms on the transactional currency, like say allowing transactions to close in renminbi (another name for China’s “yuan” which is a unit of renminbi, like sterling and pound). Or in gold denominated brics.

Those better terms could be actual cash terms, or it could be investing in a country like China has done with its Belt and Road Initiative involving debt forgiveness in return for access to a port, train line, or strategic mineral rights like say Steppestan’s other natural resource, cobalt. Never mind that Steppestan mines cobalt using children clawing cobalt out of the ground with their bare hands and who get very sick in terrible work conditions like in the Congo. China’s not worried about that as you can see from the vast amount of pollution and slave labor owned by the CCP. In that way, the sleaze factor in CCP business is right at home in Steppestan, just like they were in Afghanistan after the U.S. abandoned the post.

As if by magic, the Steppestan deals with China are denominated in renminbi, which is part of thousands of transactions, including oil deals with Saudi that are now denominated in the China currency. Every time this happens, it gets closer and closer to shifting the world reserve currency to renminbi and away from dollars.

Let’s say that Steppestan does something that angers the then-current American presidential administration, and all of Steppestan’s dollar denominated reserve accounts are frozen by order of the President. Steppestan is denied access to their own money because they are blocked from the SWIFT system. Steppestan says wait, we bought all that U.S. debt because rule of law, etc., etc., and now you’re just going to take it away from us because you can?

The price you pay for being the world’s prime reserve currency is that you don’t do things like freeze sovereign reserve accounts if you want to stick around. You can be offended, and there are many, many ways that a country like the U.S. can express that offense and even anger. One of them is called SEAL Teams, another is Delta. And there’s a lot of diplomatic steps that don’t cost the blood of our treasure. But is it worth getting knocked off as the prime reserve currency and becoming Argentina? If you think 5% inflation is bad, you ain’t seen nothing yet.

And here’s why. Steppestan is saying, I don’t want to play this game anymore and I don’t need to because I can get almost anything I need from China in renminbi or from the BRICS in the bric, and what I can’t get from them, I can get from somebody else who America has cheesed using renminbi, the bric or some other currency or even good old fashioned barter. Or I could just barter because the Global South has a lot of stuff I need. This is called “sanction proofing”.

Subduing without Fighting

So when you see stories about countries doing deals with China in renminbi, this is what it means. Will the collapse happen tomorrow? Probably not, but it’s the kind of thing that happens gradually and then suddenly. Along the way one possible outcome is that one day when the U.S. goes to borrow the hundreds of billions of dollars it needs that day to keep paying these deficits and say, finance the transfer from fossil fuels to electric along with all the grid upgrades, charging stations and the like that must be acquired, the price won’t be the same because we may have to pay sweeteners to get people to take our debt. (We may have to start doing this now because of inflation, set aside the Federal Reserve quantitative tightening and interest rate rises.)

If it happens, it will happen gradually and then suddenly in the words of Mike Campbell in The Sun Also Rises. It will be hyper inflationary. And it’s a very good reason to keep fighting for cost of living adjustments in any government payment like the statutory mechanical royalty.

The MLC certainly does.