Americans are freedom loving people, and nothing says freedom like getting away with it…

From Long, Long Time written by Guy Forsyth

Google’s UK Policy Manager Theo Bertram advised in 2012–“Follow the Money to Fight Online Piracy“. Google’s copyright lawyer Katherine Oyama endorsed this approach on behalf of Google before the U.S. Congress in 2011 (“We would publicly support legislation like what I described, the follow the money approach…”).

Several UK banks and other advertisers are now doing just that according to the London Times (“Banks pull Google ads in row over hate videos“):

Three of Britain’s biggest banks have pulled advertising from Google after their marketing appeared alongside extremist YouTube videos.

HSBC, Lloyds and Royal Bank of Scotland acted over fears that chunks of their advertising budgets have inadvertently ended up in the pockets of banned hate preachers and anti-semites. The lenders join a growing list of big advertisers who have withdrawn marketing from the search engine and its YouTube video platform. These include McDonald’s, L’Oréal, Audi and the BBC.

How might these sites have gotten a share of revenue from ads served against their videos? There’s only one way I know of that could happen, and it starts with having a Google Adsense account approved by Google.

In order to get an approved Adsense account, the party must apply for it, give out their payment information (see Step 2 “How Will I Be Paid”) and Google approves the account for monetization purposes. The applicant gets paid because Google approved them for payment.

A YouTube channel partner gets paid for advertising on their YouTube videos through an existing Adsense account, so this is a second layer of approval to associate the YouTube partner channel with the YouTube partner’s Adsense account:

So if we follow the money as Google has suggested many, many times, it is clear that it is not possible to have a monetized YouTube channel without at least two layers of approval by Google. Google also knows who to pay, which bank account to pay, and presumably the taxpayer name and tax ID number for the account. And of course I would assume that Google would be sending an IRS Form 1099 to the channel partner or otherwise complying with taxing authorities.

Following the money in this case would be very simple, particularly if Google is cooperating.

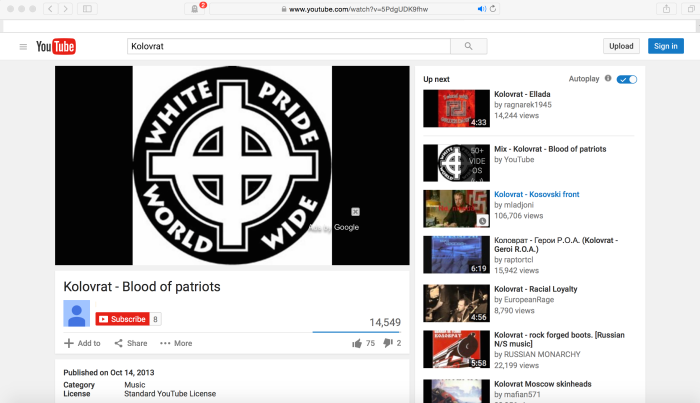

The money isn’t the only issue, however. YouTube partner accounts depicting Nazi symbolism transmitted in Germany, Austria, Switzerland or any other country with prohibitions on the dissemination of Nazi symbolism may present a different problem. Those accounts (and presumably Google itself) will be subject to the Strafgesetzbuch section 86a criminal law in Germany and analog criminal statutes in Austria and Switzerland which ban Nazi symbols like this:

And also like this:

In fact, if you do YouTube searches for bands on the ADL’s “Bigots Who Rock” list, you’ll find other examples.

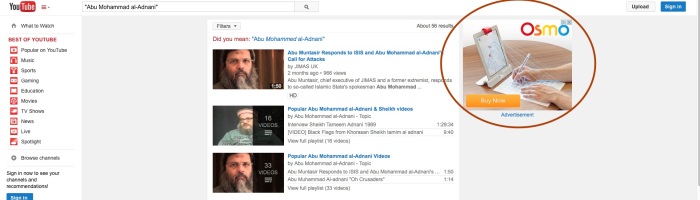

It is also worth noting that YouTube monetizes search (YouTube is the second largest search engine online) even if the videos themselves are not monetized, and that YouTube almost certainly keeps all the money such as the ad for Osmo that monetizes a search for extremist videos.

The problem that YouTube is experiencing now that has resulted in hundreds of major advertisers pulling out is not that different that the problems that Google had with music and movie piracy as described in the Megavideo indictment (pp. 8, 34):

Google had given Megaupload (or an associate of Megaupload) an Adsense account Although it appears from the indictment that at least one Adsense account was terminated, Megaupload had been operating for a while before the account was terminated. It does not appear that Google notified advertisers, recovered improper payments to Megaupload or refunded even Google’s own share of revenue to advertisers.

This is important to remember–following the money inevitably leads back to Google itself for advertisers to demand at least the share of advertisers’ money that Google kept for its own account not to mention the sums paid to the YouTube or Adsense partner. In fact, there’s an argument to be made that the YouTube or Adsense partner, however distasteful, may have done nothing wrong as between that partner and Google. It is Google that made the promise to the advertiser of where their ads would appear, not the channel partner.

The solution for this is probably best summarized by Professor Ben Edelman’s bill of rights for advertisers. The solution is ultimately going to turn on both enforcement of Google’s terms of use as well as its monetization policy. It should be obvious now that Google’s current practices on YouTube simply will not wash–the plan should be to stop the videos from being uploaded if they violate the terms of use, not relying on advertisers or the police to catch them after the fact.

This will take time to give effect of course. The good news is that Google has a host of forensic information that will be of good use to the police in some cases, but inevitably will make refunding advertising payments to Google’s clients ever so much easier.

All they have to do is follow the money.